- Medical Insurance

- Motor insurance

- Home Insurance

Dealer Repair

Dealer Repair Taxi / Towing Service

Taxi / Towing Service Pick-up Driver

Pick-up Driver Replacement Car up to 10 days/year

Replacement Car up to 10 days/year

Overview

Car insurance is like a great partner in times of need; it prevents you from receiving heavy fines and covers the losses you make in a possible accident. In short, car insurance keeps you from paying a huge sum of money from your own pocket. With the benefits we provide, we guarantee that your insurance experience is rewarding.

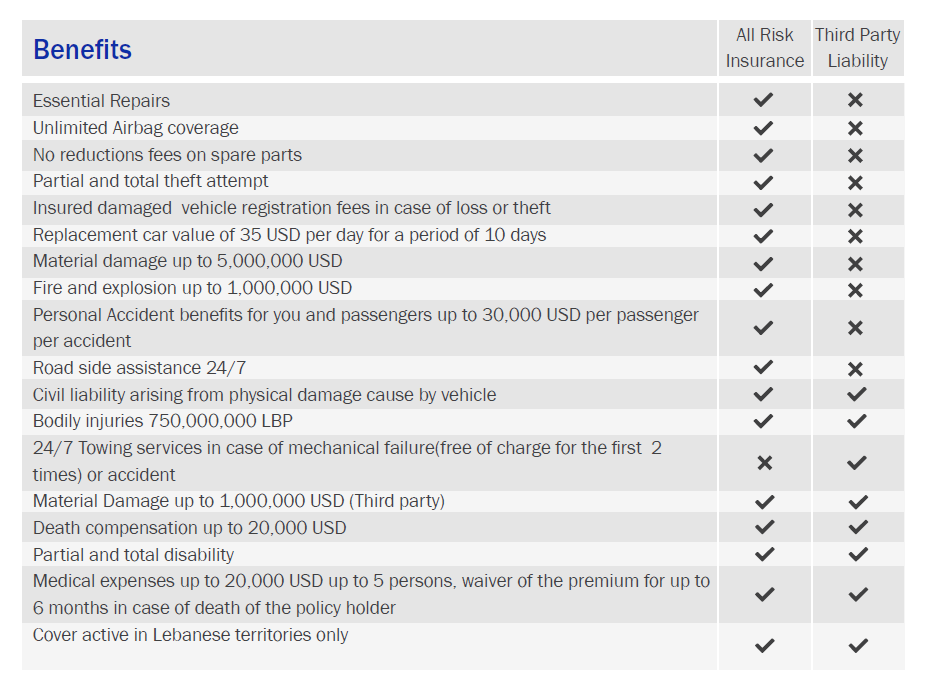

What is Third Party Liability Car Insurance?

Third Party Liability car insurance protects not only you, but also family members who may be with you in the car. The benefits of liability car insurance will apply if you find yourself responsible for damaging other properties in an accident.

What does it include?

-

- Third Party Liability for material damage with a limit up to USD 5,000,000

- Compensation in case of death per person up to USD 20,000

- Partial and Total Disability

- Medical expenses up to USD 2,000, up to five persons for up to 6 months in case of death of the policyholder

- Towing service available 24/7 in case of:

- Mechanical failure: free of charge up to 2 times

- Accident: free of charge for an unlimited number of requests

What does car insurance cover?

Whether you choose All Risk Car Insurance or Third Party Liability Insurance, you know that you will be driving securely and legally because you have got the cover you need at a price you can afford.

What is All Risk Car Insurance?

Would you be able to afford to fix your car if it was damaged? If you want to cover yourself for injury and your car for accidents, then you need all risk car insurance.

What does it include?

Partial or Total Damage

- Essential repairs

- Unlimited Airbag coverage

- No reduction fees on spare parts in case of partial damage for our platinum product

Protection

- Partial and total theft attempt

- Insured damaged vehicle registration fees in case of total loss or theft (7.5% of the insured value)

- Hold up to your vehicle

Courtesy Car

Replacement car for a value of USD 35 per day for a period of 10 days

Third party Liability

- Material damages up to USD 5,000,000

- Fire and Explosion up to USD 1,000,000 per loss

- Personal Accident benefits for you and your passengers up to USD 30,000 per passenger and per accident (with a maximum of 5 passengers including the driver)

Emergency Service

Roadside assistance and towing services 24/7

Medical Assistance

Free Medical fees up to USD 3,000 per passenger (with a maximum of 5 passengers including the driver)

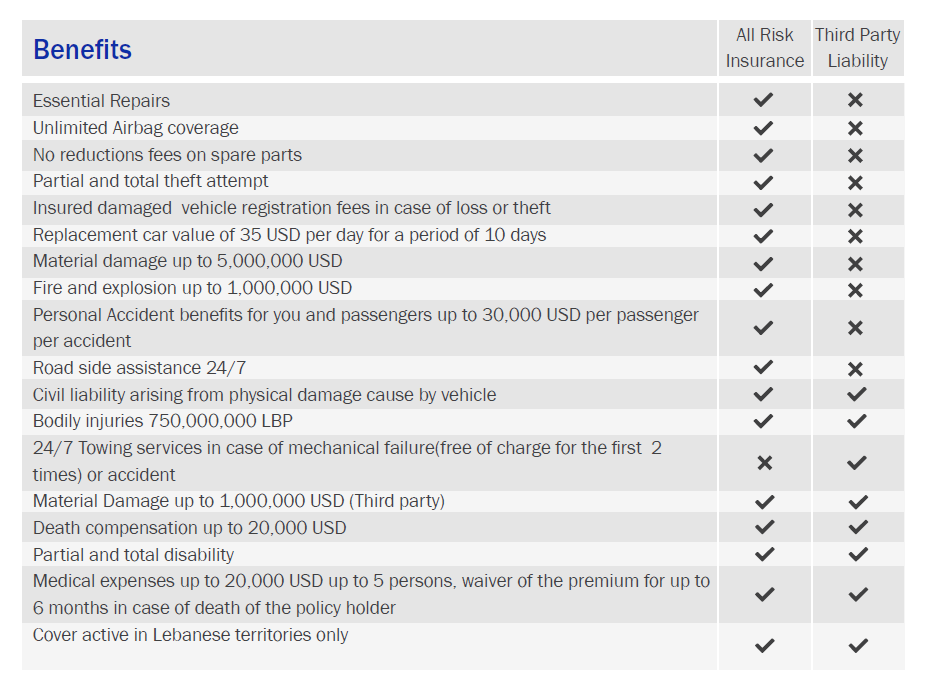

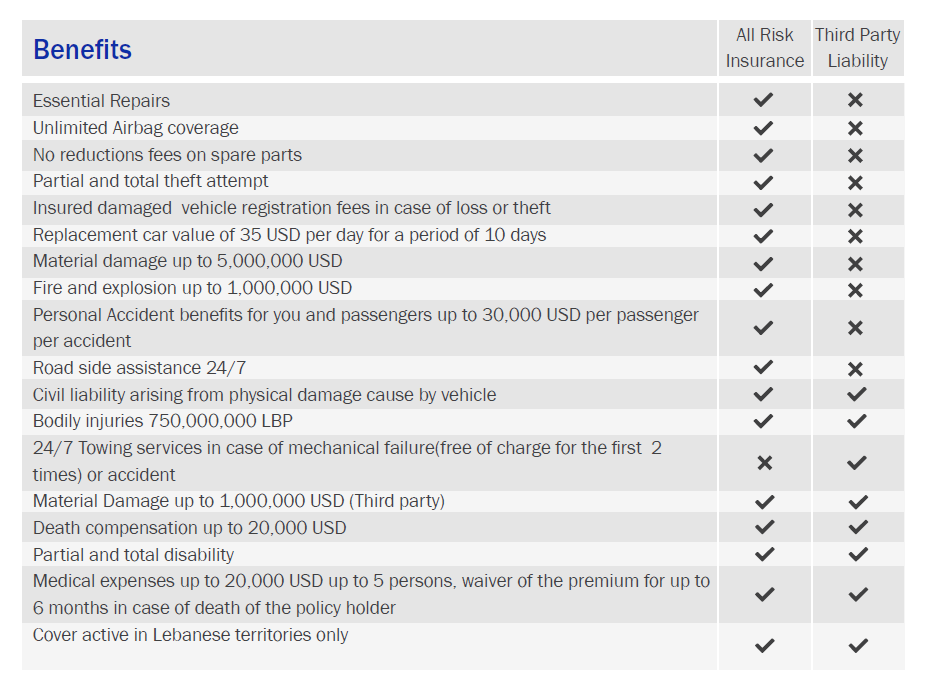

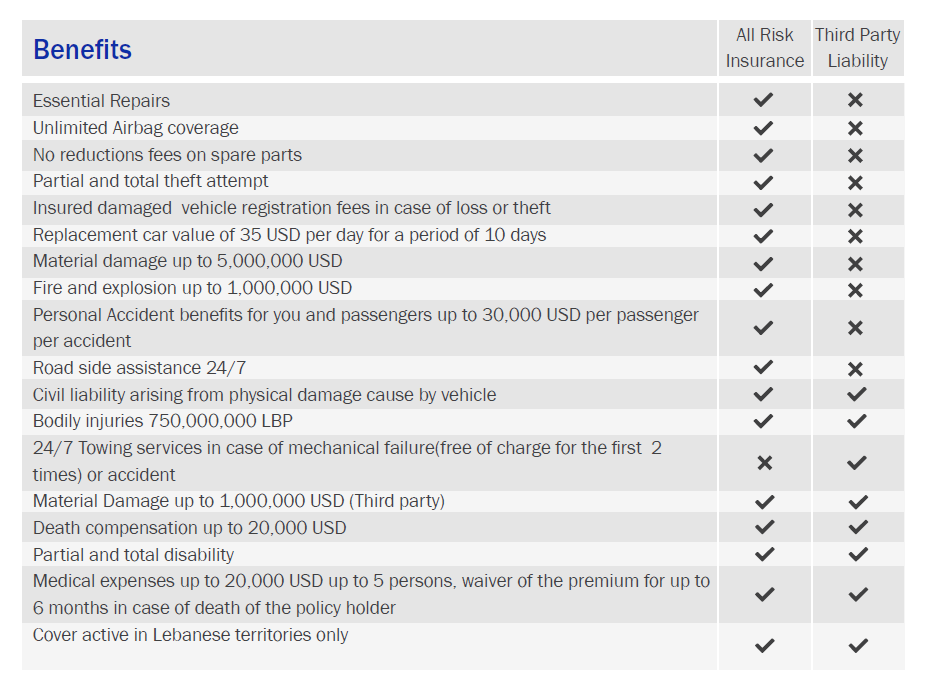

What is Third Party Liability Car Insurance?

Third Party Liability car insurance protects not only you, but also family members who may be with you in the car. The benefits of liability car insurance will apply if you find yourself responsible for damaging other properties in an accident.

What does it include?

- Third Party Liability for material damage with a limit up to USD 5,000,000

- Compensation in case of death per person up to USD 20,000

- Partial and Total Disability

- Medical expenses up to USD 2,000, up to five persons for up to 6 months in case of death of the policyholder

- Towing service available 24/7 in case of:

- Mechanical failure: free of charge up to 2 times

- Accident: free of charge for an unlimited number of requests

What does car insurance cover?

Whether you choose All Risk Car Insurance or Third Party Liability Insurance, you know that you will be driving securely and legally because you have got the cover you need at a price you can afford.

What is All Risk Car Insurance?

Would you be able to afford to fix your car if it was damaged? If you want to cover yourself for injury and your car for accidents, then you need all risk car insurance.

What does it include?

Partial or Total Damage

- Essential repairs

- Unlimited Airbag coverage

- No reduction fees on spare parts in case of partial damage for our platinum product

Protection

- Partial and total theft attempt

- Insured damaged vehicle registration fees in case of total loss or theft (7.5% of the insured value)

- Hold up to your vehicle

Courtesy Car

Replacement car for a value of USD 35 per day for a period of 10 days

Third party Liability

- Material damages up to USD 5,000,000

- Fire and Explosion up to USD 1,000,000 per loss

- Personal Accident benefits for you and your passengers up to USD 30,000 per passenger and per accident (with a maximum of 5 passengers including the driver)

Emergency Service

Roadside assistance and towing services 24/7

Medical Assistance

Free Medical fees up to USD 3,000 per passenger (with a maximum of 5 passengers including the driver)